The effective structuring of a company depends on adequately managing its tax obligations. Our advisors proactively plan your organization's tax matters promptly and in the correct format so that you avoid correcting mismanaged errors.

We guide effectively structuring a company to minimize its tax obligations and always comply with legislative requirements.

If you own a small or medium-sized business, we help you understand the implications of inaccurate reporting and confidently prepare you for future business activities.

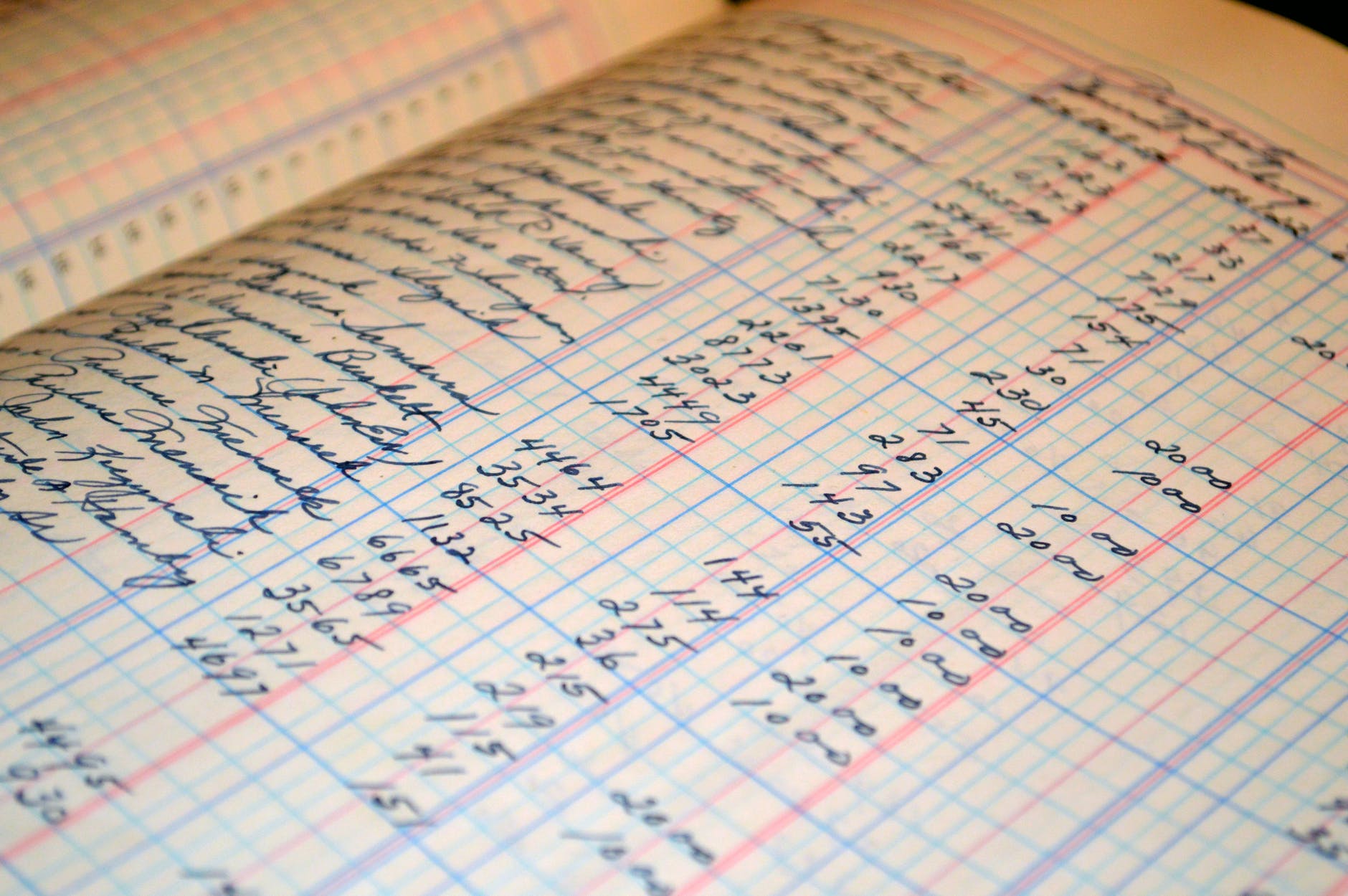

Benefit from accurate management of tax matters from the outset of a company formation with proper rectification of poorly managed records.

Our team of registered accountants advises you quickly in preparing commercial tax returns and filing them in the correct format.

The agility of our experts’ processes guarantees a presentation with the appropriate requirements, alleviating the administrative burden and ensuring a business is completely aligned with the requirements of current legislation.